The IRS has updated procedures that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes, which are further explained in these frequently asked questions, before requesting an ITIN. All features, services, support, prices, offers, terms and conditions are subject to change without notice. If you must send original documents, you can send the IRS a prepaid express envelope with your application to have them returned faster. Taxpayers with an ITIN can complete the registration process to access their IRS online account, which provides balance due, payment history, payment plans, tax records, and more.

What do I do if my name has changed since I received my ITIN?

- Bring it to your local IRS office, or use an acceptance agent (colleges, financial institutions, or accounting firms that are authorized by the IRS to assist applicants in obtaining ITINs).

- You may use it in lieu of your SSN on various official documents pertaining to your business.

- Obtaining these numbers also ensures individuals remain in compliance with tax laws.

- Even if you’re not eligible to get a Social Security Number (SSN), you’ll still need to file income taxes in the United States if you live and work here.

- You will only file a tax return to the address above once, when you file Form W-7 to get an ITIN.

- The IRS has a long list of documents or combinations of documents that can show your status and identity.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. You can fill out the necessary paperwork online but then you must print it and submit it via one of the two options above. This guide will take you through the steps of how to discountss, the average timeframe, and ways to streamline the process. Security Certification of the TurboTax Online application has been performed by C-Level Security.

The Application

You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. Tax information for foreign persons with income in the U.S. or U.S. citizens and resident aliens with income outside the U.S. Section 203 of the Protecting Americans from Tax Hikes Act, enacted on December 18, 2015, included provisions that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes, which are further explained in the ITIN Documentation Frequently Asked Questions, before requesting an ITIN.

ITIN holders can access their online account

Internal Revenue Service (IRS) to individuals who are required for U.S. federal tax purposes to have a U.S. taxpayer identification number but who do not have and are not eligible to get a Social Security number (SSN). If you’re required to file a tax return and aren’t eligible for a Social Security number, you need to apply for an ITIN (See the What should I do? section, above). The application — Form W-7, Application for IRS Individual Taxpayer Identification Number — asks details about why you need an ITIN and requires you to send in certain documents to prove your foreign status and identity. An ITIN may be assigned to an alien dependent from Canada or Mexico if that dependent qualifies a taxpayer for a child or dependent care credit (claimed on Form 2441).

Compare Small Business Loans

As an independent organization within the IRS, the Taxpayer Advocate Service helps taxpayers resolve problems and recommends changes that will prevent problems. A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS) in the administration of tax laws. It is issued either by the Social Security Administration (SSA) or by the IRS. A Social Security number (SSN) is issued by the SSA whereas all other TINs are issued by the IRS.

See IRS.gov – ITIN Updated Procedures Frequently Asked Questions. Official websites use .govA .gov website belongs to an official government organization in the United States. For a summary of those rules, please see the new Form W-7 and its instructions.

Essentially, an SSN is for U.S. citizens and authorized noncitizen residents — such as green card holders and students on visas. An ITIN, on the other hand, is for residents with foreign status. This includes undocumented aliens and nonresident aliens that conduct business in the United States.

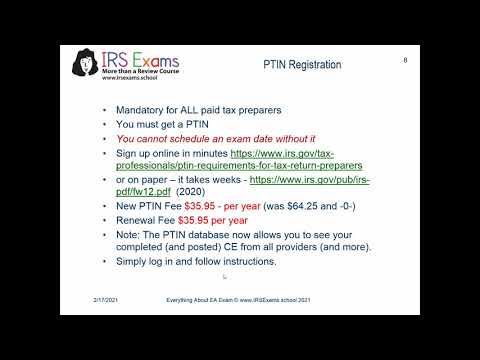

Even if you have a PTIN but you received it prior to September 28, 2010, you must apply for a new or renewed PTIN by using the new system. If all your authentication information matches, you may be issued the same number. You must have a PTIN if you, for compensation, prepare all or substantially all of any federal tax return or claim for refund.

Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. The information contained in this web site is not a substitute for advice obtained from the Internal Revenue Service or a qualified tax professional. To avoid having to set up an ITIN in person, simply fill out this form to apply for an ITIN online right now.

You can apply for an ITIN any time during the year when you have a filing or reporting requirement. At a minimum, you should complete Form W-7 when you are ready to file your federal income tax return by the return’s prescribed due date. If the tax return you attach to Form W-7 is filed after the return’s due date, you may owe interest and/or penalties. Apply for an ITIN in-person using the services of an IRS-authorized Certifying Acceptance Agent. This will prevent you from having to mail your proof of identity and foreign status documents. If you qualify for an exception, then file Form W-7 with your proof of identity and foreign status documents and supporting documentation for the exception.

That being said, it’s important to protect your EIN just as much as you would an SSN. An EIN is still susceptible to identity theft, so be careful not to leave it written in plain sight where someone might see it. U.S. residents typically do not need to worry about obtaining https://www.accountingcoaching.online/ an SSN since they have already been issued one by the SSA. What they do need to consider is taking action to safeguard these numbers. Sally Lauckner is an editor on NerdWallet’s small-business team. She has over 15 years of experience in print and online journalism.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations. For those simply operating sole proprietorships, they can use their SSN with the IRS for tax purposes and to open a business bank account. If you form an LLC, want to hire employees or would like to establish business credit, though, you’ll need to obtain an EIN.

Our partners cannot pay us to guarantee favorable reviews of their products or services. GovPlus® is a private online software technology company not affiliated nor endorsed by any Government or State agency. We do not charge for any forms, however, we charge for use of our software in assisting you with completing the form. We are not a financial, accounting or law firm and do not provide legal or financial advice. Even if you’re not eligible to get a Social Security Number (SSN), you’ll still need to file income taxes in the United States if you live and work here. If this is your situation, don’t worry—there is a way to do so.

Obtaining these numbers also ensures individuals remain in compliance with tax laws. However some people may have an individual https://www.accountingcoaching.online/present-discounted-value-economics/ taxpayer identification number instead. Which numbers you have largely comes down to your immigration status.